Crowdfunding has become one of the most transformative financing models in the modern world. Collecting small contributions from a large number of people, democratizes access to funding, enabling projects to raise capital through the collective support of individuals.

Crowdfunding is reshaping how businesses, non-profits, and individuals finance their ventures, providing access to funds without traditional barriers such as banks or institutional investors.

It is an ideal solution for startups, real estate projects, social initiatives, and much more.

Different Types of Crowdfunding Solutions

Explaining Different Types of Crowdfunding Solutions

CrowdX specializes in creating customizable crowdfunding platforms tailored to the unique needs of various sectors. Let’s dive into the range of industries that CrowdX serves and the solutions it provides.

- Investment Funds: For businesses focused on creating pooled investment opportunities, CrowdX provides crowdfunding platforms that allow users to pool their resources into professionally managed portfolios. These platforms facilitate collective investment strategies, making it easier for investors to contribute to large-scale projects.

- Real Estate Funds: CrowdX builds custom platforms for real estate crowdfunding, designed to cater to property developers, investors, and buyers. Whether it’s for acquisitions, development, or renovation projects, these platforms simplify the process of attracting and managing real estate investments, making the property market more accessible to a wider range of investors.

- Sukuk Platforms: In regions where Islamic finance is dominant, the demand for Sharia-compliant investment opportunities is high. CrowdX offers specialized platforms for Sukuk, allowing businesses to offer Shariah-compliant crowdfunding options. These platforms enable companies to raise funds while complying with the ethical standards of Islamic finance, thus opening up opportunities to a broader, faith-based investor pool.

- Debt Financing: Debt crowdfunding, also known as peer-to-peer lending, allows individuals and businesses to borrow directly from investors. CrowdX creates platforms that simplify the process of connecting borrowers with a diverse pool of lenders, enabling efficient debt financing for everything from small personal loans to large business ventures.

- Charitable Work: For non-profit organizations or those involved in social impact projects, CrowdX offers platforms that enable donation-based crowdfunding. These platforms integrate campaign tracking and donor management tools, allowing organizations to seamlessly run fundraising campaigns and engage with their donor base.

- Asset-Based Crowdfunding: CrowdX also facilitates platforms that support asset-based crowdfunding, where investors pool resources for the collective ownership of high-value assets like real estate or other tangible assets. These platforms provide investors with a stake in valuable properties, giving them the chance to benefit from the profits of the asset.

How to Choose the Right Type of Crowdfunding for Your Business

Choosing the right crowdfunding model is crucial to your project’s success. Each type of crowdfunding offers unique benefits and caters to different business needs. Here’s a breakdown to help you decide which one is best suited for your business or cause:

1- Equity Crowdfunding

- Best for: Startups and early-stage companies looking to raise significant amounts of capital in exchange for ownership stakes.

- What it offers: Investors receive shares in your business, giving them an equity stake in return for their investment.

- When to choose this: If you are comfortable sharing ownership of your company and want to attract investors who are looking for a return on their investment over time.

2- Debt Crowdfunding (Peer-to-Peer Lending)

- Best for: Businesses needing immediate funds without giving away equity.

- What it offers: Investors lend you money with the expectation that it will be repaid with interest, much like a traditional loan.

- When to choose this: If you’re a small or medium-sized business with good credit and you need a structured repayment plan instead of giving away ownership in your company.

3- Reward-Based Crowdfunding

- Best for: Creative projects, product launches, and small businesses looking for one-time funding.

- What it offers: Contributors get rewards or pre-orders of your product in return for their support.

- When to choose this: If you’re launching a product or service and want to give early backers exclusive rewards in exchange for their investment.

4- Donation-Based Crowdfunding

- Best for: Charitable organizations, social causes, or individuals seeking help for personal needs.

- What it offers: Donations without any expectation of repayment or financial return.

- When to choose this: If you’re running a nonprofit or social cause where the funds will be used for charitable purposes, and donors simply want to help out of goodwill.

5- Sukuk Crowdfunding

- Best for: Businesses or projects seeking Shariah-compliant financing.

- What it offers: Structured Islamic bonds where investors receive profits from the venture but do not earn interest, ensuring compliance with Islamic finance laws.

- When to choose this: If your business operates in a region or industry where Islamic finance is important, and you want to offer Shariah-compliant investment opportunities.

6- Asset-Based Crowdfunding

- Best for: Real estate projects and high-value asset investments.

- What it offers: Investors own a share of physical assets like real estate and receive returns based on the asset’s performance.

- When to choose this: If you’re developing real estate or another high-value asset and want to provide investors with a tangible, long-term investment.

Key Considerations When Choosing the Right Crowdfunding Model:

- Business Model: Think about how much ownership you’re willing to give up (equity) versus what you can afford to repay (debt).

- Target Audience: Are your backers seeking financial returns, rewards, or simply contributing out of goodwill?

- Project Size: Large-scale projects may benefit more from equity or debt crowdfunding, while smaller creative endeavors might do well with rewards-based crowdfunding.

- Regulatory Compliance: If operating in regions that require Shariah compliance, Sukuk crowdfunding is a great fit.

How CrowdX Empowers Businesses Across Sectors

CrowdX stands out as a versatile crowdfunding platform that offers businesses the tools they need to raise funds in a way that fits their specific industry. Whether you’re launching a new business, financing a real estate development, or raising donations for a social cause, CrowdX’s customizable solutions ensure that you have the right platform for your needs.

Here’s why businesses across sectors choose CrowdX:

- Tailored Solutions: CrowdX provides customizable crowdfunding platforms that are tailored to the specific needs of each business model.

- Compliance with Industry Regulations: CrowdX ensures that platforms adhere to relevant legal and regulatory standards, such as Shariah compliance for Sukuk crowdfunding or financial regulations for debt financing.

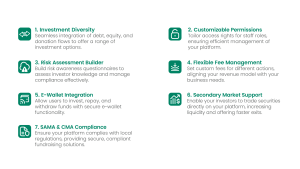

- Advanced Features: From integrated campaign tracking and donor management for non-profits to secure e-wallets and secondary market support for real estate investors, CrowdX offers a wide range of features designed to enhance user experience and streamline the fundraising process.

Why Choose CrowdX?

Conclusion

Crowdfunding is rapidly becoming a vital tool for businesses across various sectors. Whether you’re looking to pool investments for real estate, raise funds for charitable work, or launch Shariah-compliant platforms, CrowdX has the technology and expertise to help you succeed.

With customizable, secure, and regulatory-compliant platforms, CrowdX empowers businesses to tap into the vast potential of the crowd to fund their vision.

Ready to take the next step? Contact us today to explore how CrowdX can transform your crowdfunding experience.

References:

Fortune Business Insights – Crowdfunding Market Report 2023

Statista – Global Crowdfunding Statistics

Investopedia – Crowdfunding Explained

Future Business Journal – Crowdfunding for Innovation

Ethis – Sukuk: A Driving Force in the Development of Islamic Finance