The Growing Role of Peer-to-Peer Lending in Crowdfunding

Peer-to-peer (P2P) lending is revolutionizing the financial landscape by offering a decentralized method of debt financing. This model allows individuals to lend money directly to borrowers—be they individuals or businesses—bypassing traditional financial institutions like banks. With the help of online platforms, P2P lending provides quick access to capital for borrowers, while offering lenders an opportunity to earn competitive returns.

As a crucial segment of the crowdfunding ecosystem, P2P lending is providing an innovative alternative to conventional banking, attracting both investors and borrowers seeking flexible and inclusive financing options.

Key Benefits of P2P Lending

The popularity of P2P lending continues to rise, primarily due to its democratization of credit and financial inclusion. Unlike banks, which often have rigid lending criteria, P2P platforms can offer more flexible terms, opening up opportunities for a wider pool of borrowers.

At the same time, individual lenders enjoy potentially higher returns compared to traditional savings or investment vehicles, making this a compelling option for those seeking to diversify their income streams.

Advantages of P2P Lending in Crowdfunding

How P2P Lending Works

The process typically involves the following steps:

- Borrower Application: Borrowers apply for loans on the platform, submitting necessary financial and personal information for evaluation.

- Loan Listing and Funding: Approved loans are listed for potential lenders. Lenders then decide how much they wish to contribute based on the loan’s risk profile and potential returns.

- Repayment: Once the loan is funded, borrowers make regular payments, which could include interest or profit-sharing, depending on the agreement. Lenders receive their share of the repayments as income.

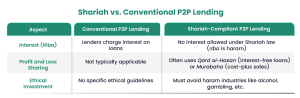

P2P Lending in Shariah-Compliant Crowdfunding

Shariah compliance in peer-to-peer lending means adhering to the ethical principles outlined in Islamic finance, particularly the prohibition of riba (interest), gharar (excessive uncertainty), and investment in haram industries like alcohol and gambling. Instead of charging interest, Shariah-compliant P2P lending platforms use alternative structures, such as:

- Qard al-Hasan: An interest-free loan where the borrower repays only the principal. This model promotes community support and ethical lending practices, ensuring that financial transactions do not exploit vulnerable borrowers.

- Murabaha: In this model, the platform purchases assets on behalf of the borrower and resells them at a predetermined profit margin. This cost-plus method aligns with Shariah principles by avoiding interest-based transactions.

By following these guidelines, Shariah-compliant P2P platforms ensure that all financial activities are transparent, ethical, and aligned with Islamic law, promoting fairness and financial inclusion

Regulatory Considerations for P2P Lending in Saudi Arabia

In Saudi Arabia, P2P lending platforms must comply with regulations set by the Saudi Arabian Monetary Authority (SAMA), which governs debt-based crowdfunding activities. As part of its effort to promote financial inclusion and innovation in alignment with Vision 2030, SAMA has established clear rules for licensing, transparency, and ethical operations for these platforms.

The regulations require all P2P platforms to operate within a framework that ensures fair treatment of borrowers and lenders.

For Shariah-compliant platforms, adhering to Islamic finance principles is crucial. This involves avoiding riba, adhering to ethical investment guidelines, and using structures like Qard al-Hasan or Murabaha. The platforms must also undergo regular audits to ensure ongoing compliance with Shariah law.

Conclusion

P2P lending is playing an increasingly vital role in the crowdfunding ecosystem, offering borrowers an accessible and flexible alternative to traditional finance while providing lenders with diversified investment opportunities.

In Saudi Arabia and other countries with strong regulatory frameworks, Shariah-compliant P2P lending is particularly well-positioned to drive financial inclusion, ethical investment, and economic growth.

As the market continues to evolve, P2P lending platforms have the potential to empower businesses and individuals, reshaping the future of debt financing in the process.

Resources:

SAMA Issues Rules for Practicing Debt-Based Crowdfunding

SAMA Regulatory Sandbox Guidelines

CMA Amendments for Crowdfunding and Direct Listing

Islamic Crowdfunding – Principles and Applications

A Shariah-Compliant Crowdfunding: What You Should Know About It